Keep Calm and Carry Credit Wisely: 8 Shopping Survival Tips

Posted on November 22, 2016

Black Friday traditionally kicks off the most wonderful time of the year, but it can also set off financial stress that will long outlive the holiday joys.

While it is natural to feel some pressure to buy that perfect gift for a spouse, child, or parent, that same pressure doesn’t have to extend to every person on your list.

So how can you make it through another holiday shopping season and escape with a minimum of financial setbacks?

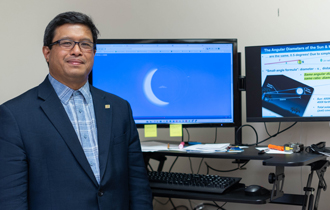

According to Dr. Reid Cummings, director of the Center for Real Estate and Economic Development at the University of South Alabama’s Mitchell College of Business, the best way to be financially successful during the holidays is to make a good plan, and then stick to it.

“Holiday shopping stress might not be altogether unavoidable, but it is entirely possible to reduce your holiday financial stress,” Cummings said.

Cummings offers these expert survival ideas that may be the best holiday gift of the season:

- Establish a reasonable, realistic holiday shopping budget and stick to it.

Tackling the malls or shopping online without knowing how much you can afford to spend on gifts for the people on your list is a terrible idea. Without a budget, you will tend to spend way too much for most all of your purchases, only to shriek with desperation when you total things up. - Set limits for the number of people on your list.

It’s normal for people to want to give presents to the people who mean the most to them. It is not necessary, however, to give everyone a gift. If you feel compelled to give a gift to your butcher, dry cleaner, hairdresser, co-worker, boss — or anyone else other than your family and closest friends — then set limits. By setting limits and deciding in advance to whom you will give, and how much you will spend, you will feel more in control of your holiday spending. - Use credit wisely.

It’s okay to use credit, but it comes with a price, and your post-holiday financial stress will greatly increase when the credit card bills hit your mailbox before the New Year even arrives. If you must use credit, wisely incorporate its use into your budget. Just as you set limits on how many people are on your shopping list, set limits on how much debt you are willing to carry into the New Year. - Be organized.

Shopping wisely is as important as spending wisely. Waiting until Christmas Eve to run around in a buying frenzy may sound like fun, but the pressure just to finish shopping will usually work against you and lead to spending way more than you had planned. Use your time wisely and organize your holiday shopping. You will likely spend far less, and have far more fun. - Stay focused.

Retailers and the advertisers they hire are experts at enticing you to purchase whatever they are selling. Don’t be fooled by all the specials and decorations. If you stick to your plan, you will stand a better chance of staying within your budget. Bear in mind though, sometimes others can get to you as well. Your family members, friends, and co-workers can often put pressure on you when they mention the coolest gift they just bought for someone. Again, do not be fooled, or persuaded. Stay focused and stick to your plan. - Remain calm.

Holiday shopping can bring out the worst in people — on both sides of the cash register. Try your best to not let someone’s rudeness, arrogance, or even anger, make you so mad that you rush to buy the first thing you find just to complete your shopping. If you do, you will most likely spend more than you had planned, and end up being upset with yourself for letting others get to you. By remaining calm and smiling often, you will feel better, and you may save money to boot. - Dealing with surprise gifts.

Sometimes, someone not on your list will surprise you with a gift. Your first reaction likely will be that you have to reciprocate, and you rush out to buy them a gift. Doing so will eat into your time and knock your budget out of whack. Instead, respond by sending a note that you have donated to a good cause in their name. The amount you give is less important than the gesture. Your donation will honor their gift to you, and will do others some good at the same time. - Enjoy yourself and give grace.

Each of us has many reasons to give thanks. It is true though, that at one time or another, certain situations can present difficulty and cause anxiety. While understanding this might happen, always remember the reason for the season. Do your utmost to take time to enjoy it, and treat others with the sincerest kindness and most loving grace. It will give you balance that impacts everything you do.

Reid Cummings has more than 30 years of experience in real estate development, leasing, management, brokerage, financial consulting, mortgage lending and construction services. Before joining USA’s faculty full-time, Cummings was a visiting instructor of finance and real estate in the Mitchell College of Business. He earned his DBA, MBA, and bachelor’s degrees from Kennesaw State University, University of Mobile and the University of North Carolina at Chapel Hill, respectively. He is director of the Center for Real Estate and Economic Development, which next year will sponsor seminars on personal finances.

Archive Search

Latest University News

-

Case Study

South engineering students tackle a senior project to design a battery...

April 16, 2024 -

Rachmaninoff and Research

A South engineering and music student wins a Goldwater Scholarship for...

April 8, 2024 -

5 Things to Know About the Solar Eclipse

South physicist Dr. Albert A. Gapud gives a primer on next week's...

April 2, 2024 -

Super Commuters

One crosses the equator line, the other eight time zones. Both Danny N...

March 25, 2024