Making It Count

Posted on January 19, 2023 by Thomas Becnel

For her final semester as an accounting student at the University of South Alabama, Jakiilah Howard was taking a full schedule of classes while working more than 25 hours a week as an intern with the Alabama Department of Revenue.

It’s a demanding program, but nothing like the load she carried last year.

Howard spent her junior year working full-time as a night clerk, 11 p.m. to 7 a.m., at a Saraland motel. She went to classes in the morning and tried to get some sleep in the afternoon and evening.

“I don’t know how I did it,” she said, laughing. “Accounting is not easy, especially when you don’t have a normal sleep schedule. And no caffeine – my energy is my energy.”

Howard – her first name is pronounced “ja-KYLE-ah” – enjoyed a more flexible schedule for her internship at the Department of Revenue. She usually got an early start, left for classes, then returned to work.

“There’s no micromanagement,” she said. “You’re responsible for getting things done that you need to do, and I love that, because I work ahead of myself. I’m only required to work 25 hours a week, but I usually do more. I’m auditing Schedule C’s, Schedule A’s, on individual tax returns. Then I request items to verify from taxpayers, and if they can’t, it’s disallowed, and they get a bill, and nobody likes that.”

Melanie Bodiford, who graduated from South in 1989, is manager of individual and corporate income tax at the Mobile office of the Alabama Department of Revenue. Howard is just the latest South intern to impress administrators at the state agency.

“The whole program has been beneficial for us,” Bodiford said. “We’ve been very pleased with Jakiilah. She went through our training and basically has the skill set of a revenue tax auditor. She reviews returns, interacts with taxpayers, and sends out letters. Hopefully, after graduation, she’ll segue into a full-time position.”

Howard is following in the footsteps of her mother, Shelia Bradley, who is a state auditor who once worked at the University of South Alabama.

“She was the first member of our family to go to college; I was the second,” Jakiilah said. “When I started at South, I used to go her to office in between classes and say, ‘I need to do some homework right quick.’ Then I’d leave her office and go to work.”

When she has free time, she enjoys cooking and sewing. She also draws and writes poetry. “It’s an outlet,” she said. “A creative outlet.”

Howard grew up in Prichard and went to Mary G. Montgomery High School, where she swam, played basketball and took Advanced Placement classes. When she enrolled at South, she was thinking about a career in medicine, but decided upon business.

Her mother suggested accounting. “’Be realistic,’” she told me,” Howard said. “‘Do something where you can make a living.’”

Her academic advisor, David Potter, helped plan her college career. Her favorite study hall was a picnic table outside the MCOB building.

Howard’s education in accounting led to her work as an intern at the Department of Revenue. Many of the Mobile tax returns she sees are routine. Others are eye-opening.

“Some of it is outrageous,” she said. “Some of it doesn’t make sense. Some of it is just sloppy.”

Howard plans to attend graduate school at South and earn a master’s degree in accounting. Someday, she’d like to leave Mobile and work in a larger city.

“I feel like it’s necessary,” she said, “for me to grow and branch out.”

Howard has always kept a busy schedule, relying on youthful energy and stamina over her mother’s warnings not to stretch herself too thin. For her last semester as an undergraduate, her schedule didn’t look too bad, so she took six classes instead of five.

“I’m a workaholic,” she said. “I like a challenge. And I don’t like two classes here, two classes there. No, give me the whole plate.”

-

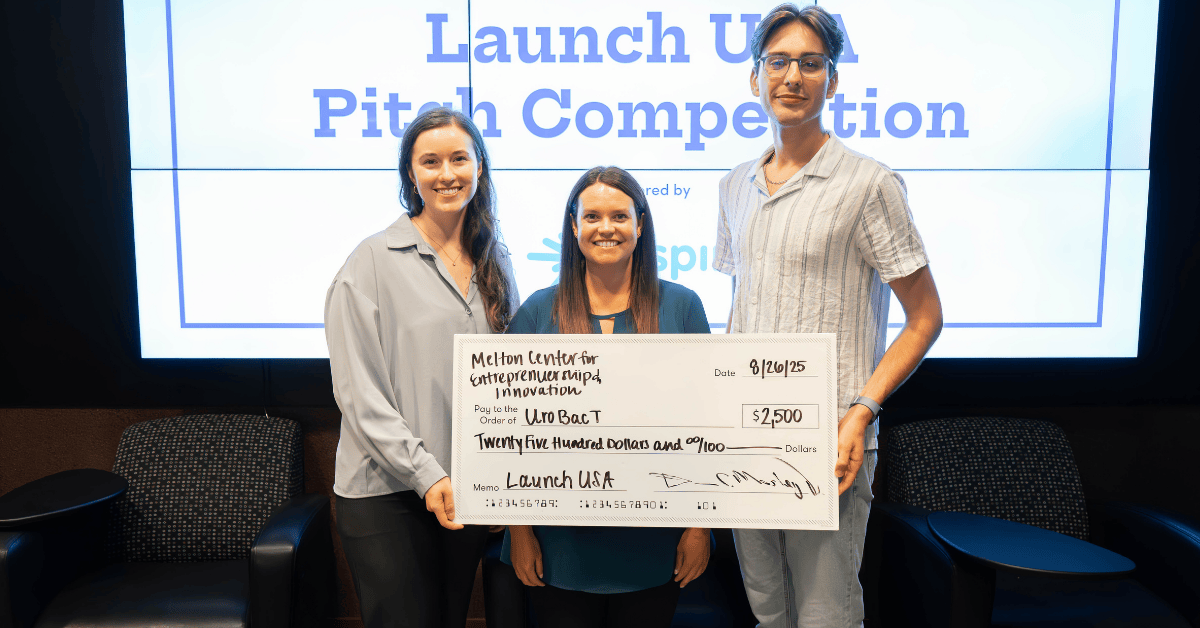

Fostering the Entrepreneurial Mindset In Budding Innovators

The Melton Center for Entrepreneurship and Innovation, in partnership ...

February 26, 2026 -

Melton Center Opens Applications for 2026 Launch USA Program

The Melton Center for Entrepreneurship & Innovation is proud to ho...

February 26, 2026 -

Real Estate Program Announces 2026 Spring Forum: "True Grit to Growth"

The Mitchell College of Business's real estate program will host ...

February 23, 2026 -

Supply Chain Major Clayton Howell Claims Alabama State Title in Microsoft Excel

The Mitchell College of Business is proud to recognize Clayton Howell,...

February 19, 2026