SABRE Cuts Commentary by Reid Cummings

Posted on July 27, 2021 by Dr. Reid Cummings

Greetings and welcome to the July 2021 edition of SABRE Cuts.

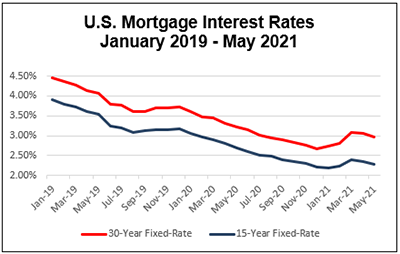

Those of you following the residential real estate market story in the last couple of years know that across the country, reports are that inventories are low, sales are active, and prices are at all-time highs. Despite what many feared in the early days of the Covid-era recession, 2020 turned out to be the strongest year for U.S. home sales since 2005. According to Zillow Research, the total value of the U.S. residential market rocketed to a staggering $36.2 trillion dollars by year’s end—up $2.5 trillion since 2019. Surely, historic low mortgage interest rates played an outsized role in the home-buying activity, as 30-year fixed rates fell from a high of 4.46% in January 2019 to a low of 2.68% in December 2020, and 15-year fixed rates dropped from 3.91% in January 2019 to 2.2% in January 2021.

Source: FreddieMac

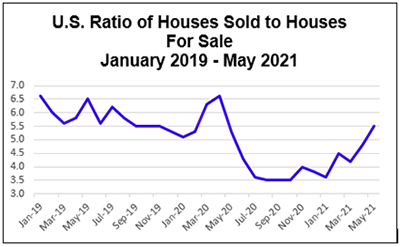

Other factors contributed as well with increased activity by Millennials entering the market as first-time buyers and widespread preferential shifts spurred by pandemic-induced remote work. The effects pushed inventories to historic lows as well. Indeed, according to the U.S. Federal Reserve Bank, the monthly ratio of houses sold to houses for sale fell from a high of 6.6 in April 2020 in the early days of economic shutdowns to a low of 3.5 in the months of August, September, and October 2020. To put that into perspective, since the measurement began in 1963, the ratio has never fallen below 3.5 and has been that low only three times: November 1998, and June and August of 2003.

Source: U.S. Federal Reserve Bank

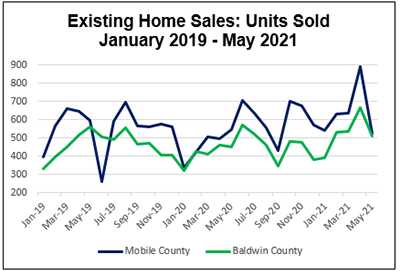

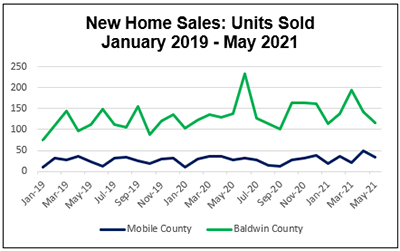

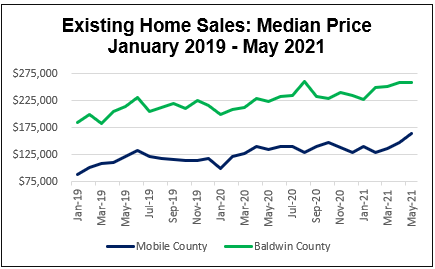

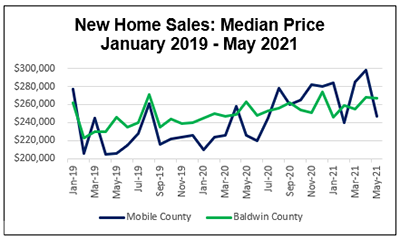

Our research suggests the same is true for our area’s residential real estate markets as well. In this month’s edition, we examine new and existing home sales and corresponding median prices for our coastal Alabama markets from January 2019 through May 2021.

Mobile County existing homes sales rose from a low of 262 units in June 2019 to a high of 892 units in April 2021, while in Baldwin County, existing homes sales also showed strong activity, increasing from a monthly low of 322 units in January 2020 to a high of 666 in April 2021.

On the new home sales front, in Mobile County sales rose from a low of 11 units in January 2019 to a monthly high of 50 homes in April 2021, while in Baldwin County, new home sales were quite brisk, rising from 75 units in January 2019 to a high of 232 units in 2020.

Pricing gains were perhaps the most impressive statistic though on both sides of the Bay. In Mobile County, existing home median prices rose from $88,200 in January 2019 to a high of $165,000 in May 2021, while in Baldwin County, existing home median prices jumped from $185,000 in January 2019 to a high of $258,400 in May 2021.

During the same period, new home prices in Mobile County ranged from a low of $204,900 in April 2019 to a high of $297,700 in April 2021, while in Baldwin County, median pricing followed a similar trajectory, with median prices growing from $223,100 in February 2021 to a high of $274,200 in December 2020.

The question now is what happens next? We believe a number of factors will influence the answer. With unprecedented federal stimulus dollars entering the economy over the last 12 months, and with strong indications of trillions more on the way, many economists and market watchers worry that inflation will grow at a much faster rate than in recent years. If this happens, the Federal Reserve will likely push the cost of money higher, effectively locking out many buyers’ abilities to service higher levels of mortgage debt. Another key factor will continue to be the cost of purchasing a home. Since 1963, existing home median prices have risen from a low of $20,012 to a March 2021 high of $314,769. Over the same period, new home median prices rose from a low of $17,200 to a May 2021 high of $380,700. Finally, even though the ratio of homes sold to homes for sale has ticked slightly higher in recent months, as many of the 4.8 million Millennials turning 30 in 2021 prepare to enter the housing market for the first time, tight supplies will likely remain a critical factor.

We hope you have seen our recent announcement that we will host our first annual SABRE Analytics Summit on November 18, 2021 here on our beautiful University of South Alabama campus. Bringing together industry leaders, businesses, academia, non-profits, local governments and emerging talent from across the Central Gulf Coast region, this one-day event is dedicated to learning the latest trends in practical applications of business analytics and exchanging knowledge among peers in this rapidly growing field. There are many opportunities for you to participate and we hope you will make plans to attend.

Until next time, from everyone at SABRE, we wish you and yours all the best.